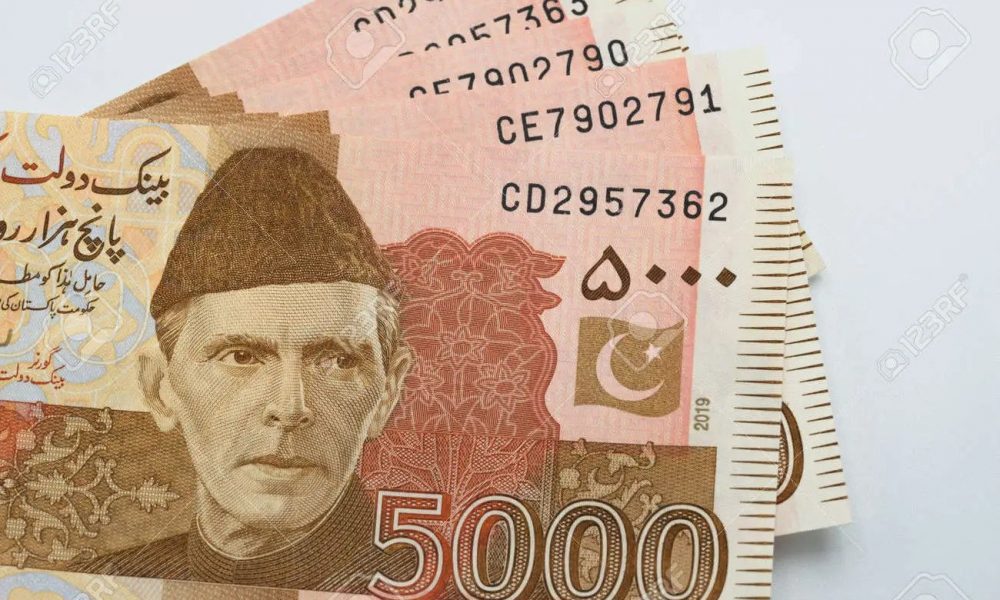

How Pakistan Is Dealing With Wealth Inequality That Prevails In The Country

It is very important that the government must intervene to address the wealth inequality in Pakistan. Relying on markets and competition for the long-term prosperity of citizens is what causes wealth inequality.

Reflections Of Market Failure

Over the past few years, it has become increasingly difficult for the banking system to provide easy financial access to different sectors of society. Most economies make sure that home finance is easily available to people that want to get home ownership. Home financing is a way to reduce the wealth gap between the fortunate and less fortunate people in the country.

Pratikxox/Pexels | Wealth inequality creates more burden on the economy.

A typical family in Pakistan has a sole breadwinner in their 30s with a spouse and two kids. The breadwinner works in a mid-sized company in a busy city and will probably be living in a rented property whereby the rent amount is approximately PKR 20k ($96.5) per month. This rent is likely to increase at a rate of 10% per annum but if the salary doesn’t account for the growing house expenses, then it’s likely that this expense will eat away most part of the salary! In this case, there will be no room for savings or catering to other family needs. If an average employee could buy their home by paying the amount they used to pay as rent, there will be two key benefits from it. Firstly, mortgage payments are fixed so the person will be able to gather some savings. Secondly, owning a home would reduce the feeling of anxiety and despair as the family will be able to meet their financial needs more effectively.

Rompalli Harish/Pexels | Owning a house offers a chance for an average person to fulfill their needs in a better way

Importance Of Policies That Counter Wealth Inequality

The main cause of market failure in the country was that until now, the banks or government had failed to introduce policies to reduce wealth inequality. The government has now introduced programs such as “Mera Pakistan Mera Ghar” in compliance with the Conventional and Shariah law. The program is specifically designed for people who want to buy 125, or at most, 250-square-yard houses. According to the program, the government subsidizes the markup payment. Also, partial risk coverage is born by the Pakistan Mortgage Refinance Company.

Sora/Pexels | There should be more government-funded programs to help people buy homes.

The typical loan size for a 125-square yard home is PKR 3 million (Approx. $14.5k). To date, the program has approved $1.01 billion in housing loans. The decision to approve or reject loans rests with the bank and not with the government. The banks look at the credentials of each applicant and then decide who is eligible to bear the monthly expenses. The world bank has also signed an agreement to show its support for this program.

This program is the best example of how the governments can put the tax money collected to good use i.e. in a way that benefits the society as a whole. Further interventions from international institutions will support such programs and reduce wealth inequality in the country.

More in Wealth

-

`

How This Trendy Lifestyle Can Help Business Owners Create Better Workspaces

In a world seemingly ruled by consumption, an alternative lifestyle that promotes the total opposite has emerged. Today, minimalism is no longer just an...

June 6, 2023 -

`

How Busy Entrepreneurs Can Find a Healthy Balance Between Personal and Work Life

Entrepreneurs are known to wear multiple hats. Building a business from the ground up on their own, they need to be...

May 11, 2023 -

`

How to Improve Your Sleep Quality: Simple Tips for Better Sleep

Sleep is essential for our physical and mental health, yet many of us struggle to get a good night’s rest. Whether...

April 28, 2023 -

`

Find Out Which Family Guy Cast Members Has Earned The Most Throughout the Years

Movie stars may get all the glory but television has slowly but surely become a lucrative gig for many actors and...

April 7, 2023 -

`

How This 2nd Generation Immigrant Entrepreneur Landed a Business Deal with a Billionaire

Immigrants and their children often have to work harder than to prove themselves and achieve the same level of success that...

April 5, 2023 -

`

Entrepreneurs Can Create More Genuine Business Connections with This One Social Interaction Trick

Succeeding as an entrepreneur involves just as much about networking as much as behind the scenes work. Meeting and making connections...

April 1, 2023 -

`

This Man Made Billions from Coronavirus Crash But He Might Get in Trouble for It

A lot of investors are currently dealing with the aftermath of the coronavirus panic’s impact on the stock market. Both small...

March 17, 2023 -

`

Skip Your Next Trip to the Salon with These Genius At-Home Beauty Treatments

While being unable to leave one’s home for an extended period of time due to a pandemic isn’t ideal, one can...

February 18, 2023 -

`

Zac Efron Once Met Leonardo DiCaprio at a Basketball Game and You’ll Never Guess What Happened Next

Hollywood is truly a small world. Celebrities often end up being friends with their fellow stars, what with them moving in...

February 18, 2023

You must be logged in to post a comment Login