How to Take Back Control Over Your Finances When Everything Else Is Falling Apart

The widespread disruption to normal life caused by the coronavirus pandemic not only halted the social lives of Americans but also threatened their livelihood. The current climate certainly led many to reevaluate their financial well-being and preparedness in times of uncertainty.

This may also mean feelings of helplessness over one’s finances. But while there are aspects that people have no control over, there are important money matters that they can more or less still manage to protect themselves from taking more hits during the crisis at hand.

Staying Persistent with Saving

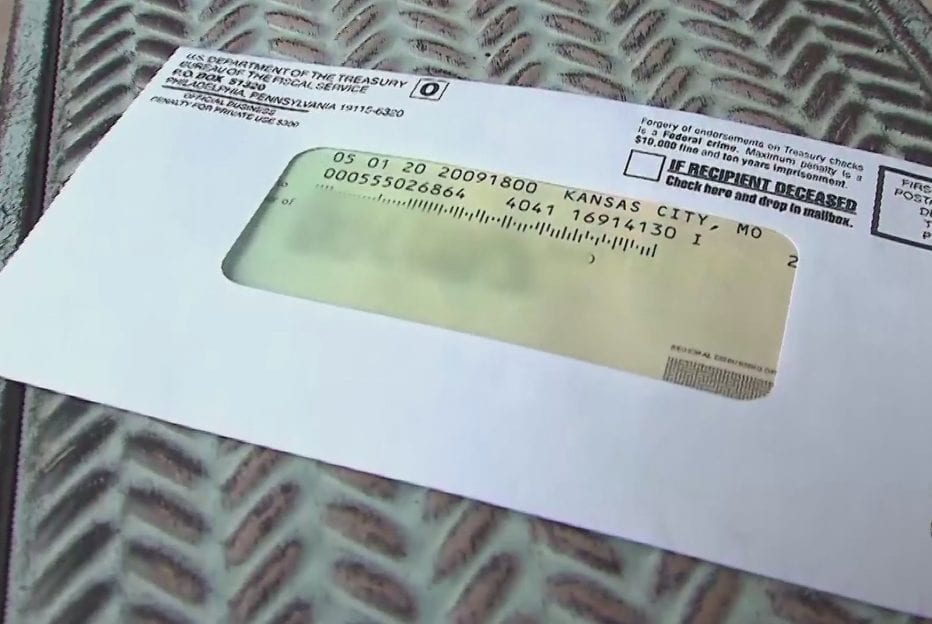

CBS Tampa | Those who are still financially sound are recommended to add their upcoming stimulus checks towards their emergency fund

Those lucky enough to still have a source of income should make sure to set aside more money into their savings accounts more than ever. Although the best time to build an emergency fund is way before disaster actually strikes, it’s still advisable to continue to stay disciplined with saving, especially for a one-year emergency fund. This tip is advocated for by financial expert Ramit Sethi during one of his recent ‘fireside chats’ where he gives away money advice in the backdrop of the coronavirus pandemic.

Staying on Track with Goals

Unsplash | Make necessary changes to your plans but stay on the same path to achieve it

The rapid spread of the novel coronavirus has practically changed the way that a good part of the world’s population lives. However, this shouldn’t mean that one has to put a stop to or completely change their plans for the future. It’s fine to continue working towards previously planned goals whether it’s preparing for retirement or saving for a trip.

Getting Insured

Unsplash | Those with dependent families are specifically advised to get a policy

It may seem too late now but it would still be worth it to finally get insurance protection. In fact, signing up for term life insurance remains to be an affordable process even with concerns over the coronavirus. Another kind of insurance people would benefit from having is a disability.

Doing so would ensure that a person would have something to replace their income should they become unable to continue working due to an injury or sickness. The good news is that COVID-19, the disease caused by the coronavirus is covered under standard policies.

Staying on Top of Debts

Lastly, remember that the current health crisis is a national one with many people in the same boat. Thus, lenders are willing and are making adjustments for their affected borrowers. People who may be unable to make their monthly payments can directly contact their lenders to figure out what options they have. Some may even offer waiving interests or deferring payments.

More in Business

-

`

The Mesmerizing Transformation of Halsey: A Musical Icon Turned Makeup Maven

In the dynamic world of beauty and self-expression, Grammy nominee and former 30 Under 30 awardee, Halsey, has taken a remarkable...

April 18, 2024 -

`

The 10 Most Promising Investments in 2024

In the unpredictable world of investments, lat year surprised us with the stock market thriving against all odds. Despite looming recession...

April 18, 2024 -

`

Study Shows Employees Value Work-Life Balance Over Pay

Gone are the days of chasing the almighty dollar without a second thought. Randstad, the world’s leading employment agency, conducted a...

April 17, 2024 -

`

How to Get a Startup Business Loan with No Money: Your Step-by-Step Guide

Securing funding for your entrepreneurial dreams can feel like climbing Mount Everest without oxygen. It’s challenging, but there are paths to...

April 16, 2024 -

`

How Much is Ryan Reynolds Net Worth?

Ryan Reynolds, the quick-witted Canadian actor with a million-dollar smile, has carved a unique path to Hollywood stardom. But his journey...

April 11, 2024 -

`

Why Italy Is the Perfect Solo Adventure Spot

Embark on a soul-stirring solo adventure through the captivating landscapes and rich tapestry of Italy, where every cobblestone street whispers tales...

April 10, 2024 -

`

What is Provisional Credit and How Does It Work?

Have you ever checked your bank statement and noticed the term “provisional credit.” This term frequently appears during disputes or chargebacks....

April 9, 2024 -

`

Elon Musk’s OpenAI Lawsuit | Are OpenAI’s Financial Motives Overshadowing Its Mission Statement?

A recent legal battle has rocked the world of artificial intelligence (AI). It pitted Elon Musk against OpenAI, the research company...

April 8, 2024 -

`

Cultivating Prosperity: Lunar New Year Traditions for Financial Abundance

As we usher in the Lunar New Year, the traditions that accompany this vibrant celebration are not just a cultural spectacle...

February 10, 2024

You must be logged in to post a comment Login