4 Quick Ways To Build A Wealthier Empire Quicker

Staying motivated:

To be successful, you must be motivated and stay focused on your goal. Motivation guides you to make the right decisions and choices that help you move towards your destination quicker and healthier. Stay determined to achieve your goal and work around with ideas and efforts to get you where you want to be.

In the workplace, common motivation factors are financial security, freedom for decision making, salary, recognition, health insurance, etc. Motivation also helps you stay committed to yourself. Whatever time and effort you put into your work would be worthwhile because it will only bring you closer to your goal without much loss.

Saving every month:

Pixabay/ Pexels | Not everyone was fortunate enough to find significantly large gold nuggets

No generation wealth plan can begin without investing and saving up your money. Financial advisors advise savings as your priority to progress towards a wealthier and healthier future. Savings help you trim your discretionary spending, and you always get the ultimate result in cases of emergencies or during the retirement period.

Since life moves on so fast and our routines are always swamped with work and other responsibilities, you can automate your savings to be automatically transferred to your savings account once you get your paycheck. You can also link your account to an IRA account and set up automatic regular scheduled transfers.

Earning through side hustles:

You can use your talents, skills, and abilities and work it on side gigs to earn some extra cash to complement your day job and increase your overall income and total savings. If you market your skills wisely, you can easily make an additional $5 hundred to $50 thousand every month.

These gigs range from freelance content writing, freelance translation, working as a virtual assistant, coaching, tutoring, fitness instructor, or working as a teacher’s assistant in your university or college. Some jobs require a little bit of time and attention, while others can quickly work while doing other tasks and don’t require professional training or money investment.

Tima/ Pexels | Be specific with how much you want to save from the start

Buying rental properties

You can double your savings by making a profitable investment in real estate. One of the key ways to build a bigger financial empire is to earn a passive income, for example owning a rental property. You should manage the property properly and invest a healthy amount of money to make back through rent. This could be another method for a steady income for every month.

Pixabay/ Pexels | You aren’t wealthy until you have something money can’t buy

Your tenants can deal with occasional maintenance issues protecting you from unnecessary extra expenditures. Unlike mortgage payments, your rents would gradually increase with time, and the money would come directly to you. You can even sell the property once the property’s value rises in the market. Similarly, you could also invest 5 to 10 percent of your money in the stock market or potential business to increase your wealth as the venture or the stock grows over time.

More in Wealth

-

`

What Must an Entrepreneur Do After Creating a Business Plan? Here’s a Step-By-Step Guide

Many successful entrepreneurs start with a solid business plan detailing the factors of their business, such as marketing, funding, legal considerations,...

June 2, 2024 -

`

Barbie Movies Are Outperforming Other U.S. Movies in China – Here’s Why

The Barbie movie is a huge hit in China! While lots of American movies usually do not do so well there,...

April 26, 2024 -

`

Hollywood Greatest Comebacks: Actors Who Staged Remarkable Returns

Hollywood may sparkle with glitz and glamor, but it’s a tough business. Stars who once basked in the spotlight can find...

April 26, 2024 -

`

Misinformation Is the New Normal: How You Can Spot Misinformation Online

In the ever-evolving world of the Internet, where information and misinformation intertwine like vines, it is essential to know how to...

April 25, 2024 -

`

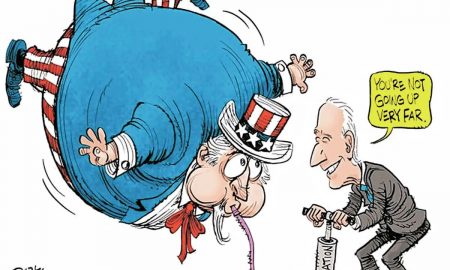

America is Rich But Americans Are Poor | This Best-Selling Book Explains Why

In the midst of America’s wealth and global dominance lies a startling and often overlooked reality: The persistent existence of poverty....

April 25, 2024 -

`

What They Don’t Teach You in School About Money

From an early age, we’re told that going to school and getting a degree will set us up for financial success....

April 24, 2024 -

`

Work Presentations: How to Say Goodbye to Boring Office Meetings

Picture this: you’re in a conference room, surrounded by colleagues. The lights dim, a projector flickers to life, and there they...

April 24, 2024 -

`

Essential Documents for Opening a Business Bank Account: Your Checklist

Embarking on the entrepreneurial journey is exhilarating, but navigating the financial side of your venture requires thoughtful consideration. One pivotal step...

April 23, 2024 -

`

Gwyneth Paltrow Was Once Called out by NASA for This Bizarre Reason!

Once upon a time, Gwyneth Paltrow was considered to be one of the most promising actresses of her time. While she...

April 23, 2024

You must be logged in to post a comment Login