Top 5 Long-Term ETFs You Should Buy & Hold in 2025

If you are looking for a stress-free way to grow your wealth, long-term ETFs might just be your ticket. These investment options are easy to manage, cost-effective, and designed to perform well over the years.

Whether you are new to investing or a seasoned pro, these ETFs are perfect for building a stable portfolio you can hold onto with confidence:

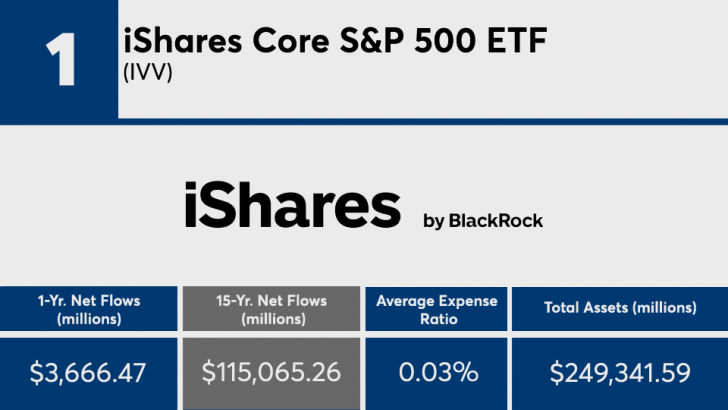

iShares Core S&P 500 ETF (IVV)

The iShares Core S&P 500 ETF (IVV) is a superstar in the world of long-term ETFs. Tracking the iconic S&P 500 index gives you exposure to 500 of the largest U.S. companies. Think of it as owning a piece of the biggest names in the business, from Apple to Microsoft.

The News / With an ultra-low expense ratio of just 0.03%, iShares Core S&P 500 ETF keeps costs down while delivering steady growth.

However, what makes IVV so appealing is its proven track record. Over decades, the S&P 500 has consistently delivered returns that outperform many other investments. This ETF is ideal for anyone looking to grow their money passively without getting bogged down by complicated strategies.

Vanguard Total International Stock ETF (VXUS)

If you want to spread your investments beyond U.S. borders, Vanguard Total International Stock ETF (VXUS) is your go-to option. It is a powerhouse that provides exposure to over 7,000 companies in markets worldwide, from Europe to Asia.

With $442.8 billion in assets, it is one of the most trusted names in global investing. So, VXUS is perfect for diversifying your portfolio. The global economy is always shifting, and having international exposure means you are not relying on one region’s performance. Plus, its expense ratio of 0.08% makes it cost-effective.

iShares Core S&P Small-Cap ETF (IJR)

For those looking to invest in smaller companies with big growth potential, the iShares Core S&P Small-Cap ETF (IJR) is a gem. This ETF focuses on small-cap U.S. companies, offering a chance to tap into the entrepreneurial spirit that drives the economy.

With an expense ratio of 0.06% and $94.7 billion in assets, it is a solid choice for long-term investors.

Small-cap stocks often fly under the radar. But they can deliver impressive returns over time. IJR provides a diversified way to invest in these rising stars without the high risk of picking individual stocks.

Invesco QQQ Trust (QQQ)

This ETF tracks the Nasdaq-100, home to some of the most exciting tech and non-financial companies on the planet. With $316.6 billion in assets, QQQ is the ultimate choice for tech-savvy investors who want to ride the wave of future growth.

Art / Pexels / Companies like Tesla, NVIDIA, and Amazon dominate QQQ’s portfolio. This gives you access to industries shaping tomorrow.

While its expense ratio of 0.20% is higher than others on this list, the potential for growth makes it well worth the cost. So, if you are in for the long haul, QQQ’s high-growth focus can be a game-changer.

Vanguard Dividend Appreciation ETF (VIG)

Dividends are the bread and butter of many long-term investors, and Vanguard Dividend Appreciation ETF (VIG) is built for those who value stability. This ETF focuses on companies with a strong history of growing their dividends year after year. With $106 billion in assets and an expense ratio of 0.06%, VIG combines reliability with affordability.

What sets VIG apart is its focus on quality. The companies in this ETF are leaders in their industries, known for steady performance and shareholder rewards. It is a fantastic choice for investors who want to enjoy long-term growth while earning passive income along the way. This long-term ETF proves that you don’t have to sacrifice returns for peace of mind.

More in Business

-

`

How to Work Out the Interest Rate on a Car Loan?

When financing a car, understanding how to work out the interest rate on a car loan is crucial. Whether you’re eyeing...

August 28, 2024 -

`

How Realistic Is Getting a Mansion Without Having a Business?

Can you get a mansion without having a business? Well, it is a question many aspiring homeowners and investors ask themselves....

August 21, 2024 -

`

Who Is Chris Brown Dating in 2024? R&B Musician’s Romantic Past Exposed

Chris Brown has captivated audiences worldwide with his exceptional talent in music and dance. Naturally, his fans are curious about his...

August 13, 2024 -

`

How Long Does It Take to Buy a Car?

How long does it take to buy a car? This question might cross your mind if you are gearing up for...

July 30, 2024 -

`

Do You Get Paid the Extra Hour for Daylight Savings?

Daylight Saving Time (DST), that annual ritual of “springing forward” and “falling back,” often sparks a flurry of questions, especially for...

July 23, 2024 -

`

Learning Hunting-Related Safety Skills: 5 Fool-Proof Techniques

What is the best way of learning hunting-related safety skills? If you have ever asked yourself this question, you are in...

July 10, 2024 -

`

Has the Saudi Arabia Petrodollar Agreement With the U.S. Ended?

In the complex landscape of global finance, rumors and misinformation can spread faster than facts, leading to confusion about crucial economic...

July 4, 2024 -

`

The Tyson Foods Boycott Explained – The Rise of Online Activism

Tyson Foods, a powerhouse in the meat and poultry industry, is in hot water following its controversial decision to lay off...

June 25, 2024 -

`

Will There Be a New Season of “The Kardashians” After the Brief Hiatus?

Fans of the iconic reality TV series are buzzing with anticipation: will there be a new season of “The Kardashians” after...

June 18, 2024

You must be logged in to post a comment Login