Has the Saudi Arabia Petrodollar Agreement With the U.S. Ended?

In the complex landscape of global finance, rumors and misinformation can spread faster than facts, leading to confusion about crucial economic agreements. A recent story claimed a seismic shift in the global economy, asserting that the Saudi Arabia petrodollar system had ended.

This claim suggests a pivotal change in how Saudi Arabia conducts its oil transactions, purportedly moving away from U.S. dollars—a cornerstone of global oil trade since the mid-20th century. However, the truth behind this claim is much less dramatic.

The Rumors of the 50-Year U.S.- Saudi Arabia Petrodollar Deal

Contrary to the swirling rumors, no formal 50-year agreement has bound Saudi Arabia to settle oil trades exclusively in U.S. dollars.

@aplasticplant | Instagram | No formal 50-year agreement has bound Saudi Arabia to settle oil trades exclusively in U.S. dollars.

This narrative seems to have been concocted to underline an anticipated decline in dollar dominance, perhaps to stir interest in alternatives like cryptocurrencies. David Wight, a historian who has extensively researched the petrodollar phenomenon, clarifies that his investigations into declassified documents reveal no such deal. Instead, what exists is a series of strategic financial relationships and policies enacted over decades.

Saudi-U.S. | Real Agreement With Different Stakes

The real deal between Saudi Arabia and the United States dates back to 1974, but it revolved around security and financial investments, not mandatory oil trading in dollars. The U.S. agreed to supply Saudi Arabia with advanced military technology.

In return, Saudi Arabia invested heavily in U.S. Treasury bonds, at one point reportedly owning up to 30% of the debt instruments. Today, the Kingdom holds about $136 billion in U.S. Treasuries, a stark decrease proportionate to the U.S.’s now nearly $35 trillion national debt.

@aplasticplant | Instagram | The real deal between Saudi Arabia and the United States revolved around security and financial investments, not mandatory oil trading in dollars.

Why the Dollar Dominates Oil Transactions

The persistence of the U.S. dollar in oil transactions, and indeed in international trade at large, is not due to any single agreement but rather the dollar’s overwhelming prevalence in global finance. The dollar offers the most favorable exchange rates due to its wide use, reinforcing its position through what economists call a ‘network effect.’

According to the latest figures from the International Monetary Fund (IMF), the dollar comprises 58% of global foreign exchange reserves, underscoring its central role despite recent declines in its share.

Shifts in Global Currency Dynamics

jcomp | Freepik | The persistence of the U.S. dollar in oil transactions is not due to any single agreement but rather the dollar’s overwhelming prevalence in global finance.

While the Saudi Arabia petrodollar deal may be a myth, shifts in global currency use are real. For instance, Saudi Arabia’s participation in the mBridge project—a digital currency initiative involving several countries, including China, which does not currently support dollar transactions—indicates a diversifying financial landscape.

Moreover, with China becoming a major oil purchaser from Saudi Arabia, there’s increasing discussion about using currencies like the renminbi for oil transactions, especially as China encourages the use of its currency in international trade.

Saudi Arabia also engages with the BRICS group (Brazil, Russia, India, China, South Africa, Iran, Egypt, Ethiopia, and the United Arab Emirates), which advocates for using local currencies over the dollar in trade transactions. These moves suggest a gradual, albeit slow, shift towards less dollar-centric trade practices. Nonetheless, the Saudi Riyal’s peg to the dollar continues to incentivize the kingdom to maintain strong ties with the U.S. currency, which is crucial for its economic stability.

More in Wealth

-

`

Jason Momoa Shocks Fans With Clean-Shaven Look for ‘Dune 3’

Jason Momoa has officially said goodbye to his signature beard—and it’s for a role that fans have been eagerly anticipating. The...

August 15, 2025 -

`

Why Fast Growth Can Hurt Your Business More Than Help It

Scaling a business is exciting. Growth means progress, more customers, and broader influence. But pushing too hard, too fast can pull...

August 10, 2025 -

`

2 Game-Changing Stocks That Could Build Generational Wealth

There’s no shortage of investment ideas in the market. But every once in a while, a few names emerge that offer...

August 3, 2025 -

`

This Influencer’s Active Videos Inspire, But Offline She Battles a Painful Condition

Aurora McCausland appears full of energy across her TikTok and Instagram feeds. With over 300,000 followers, she’s seen dancing through her...

July 27, 2025 -

`

Top 5 Long-Term ETFs You Should Buy & Hold in 2025

If you are looking for a stress-free way to grow your wealth, long-term ETFs might just be your ticket. These investment...

January 8, 2025 -

`

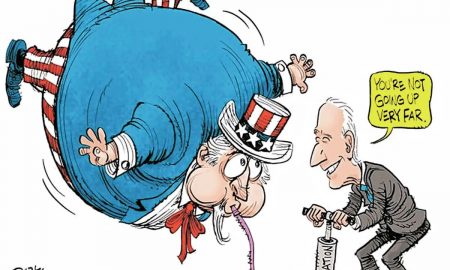

Memes Mock Inflation & Economy As President-Elect Donald Returns to Office

When it comes to tackling serious topics like the economy, political cartoonists have a unique way of making us laugh, think,...

January 8, 2025 -

`

DOJ Offers Google “Extreme” Proposal to Sell Chrome to End ‘Monopoly’

Google’s monopoly is under siege as the U.S. Department of Justice (DOJ) delivers a game-changing proposal. In a bold move, the DOJ...

December 1, 2024 -

`

Behind the Scenes of the 1969 Musical “Sesame Street”

1969 marked a revolutionary moment in television history. It was the birth of “Sesame Street,” a show that would change children’s...

September 10, 2024 -

`

When to Wax Before Vacation for the Best Results?

Planning a vacation involves a lot of preparation, and if waxing is part of that preparation, timing it right is crucial....

September 7, 2024

You must be logged in to post a comment Login