Inside the Hidden Investments Powering Deep-Sea Mining by Global Banks

Deep-sea mining sounds like science fiction, but the money behind it is very real. While public debate focuses on climate goals and clean energy, large financial institutions continue to fund companies that mine the ocean floor. These investments rarely make headlines, yet they shape the future of one of Earth’s least understood ecosystems.

More than 20 major banks have publicly said they will not fund deep-sea mining. At the same time, investigations show at least $684 million still flowing into related companies. Big names like Deutsche Bank, UBS, Credit Suisse, Credit Agricole, and BNP Paribas appear on investor lists.

The gap between what banks say and what they fund keeps growing, mostly out of public sight.

Green Talk vs. Real Investment Choices

Thant / Unsplash / Banks often defend their actions using fine print. Some say their pledges only cover direct project financing, not investments in parent companies or suppliers.

That technical split allows money to keep moving while public promises stay intact. Critics call this strategy polished greenwashing with better legal wording.

Environmental finance experts say profit pressure explains much of it. High return expectations push banks toward sectors with big upside, even if risks remain unclear. Greenpeace analyst Mauricio Vargas argues these institutions want to avoid bad headlines without walking away from future gains.

In contrast, Norway’s Storebrand took a different path, cutting millions in exposure and citing scientific uncertainty as reason enough to step back.

Public Funds and Asset Managers Join In

Private banks are not alone in this story. Public pension funds and taxpayer-backed investments also appear in portfolios linked to deep-sea mining. Even countries that support a global pause still hold indirect stakes through complex investment vehicles. That contradiction frustrates voters who assume public money follows public policy.

Large asset managers play a major role here. Goldman Sachs holds roughly €187 million in companies tied to seabed extraction. The firm promotes itself as a leader in ESG investing, yet it has no clear policy against deep-sea mining. Former BlackRock executive Tariq Fancy has said short timelines make it tempting to chase returns now and manage reputations later.

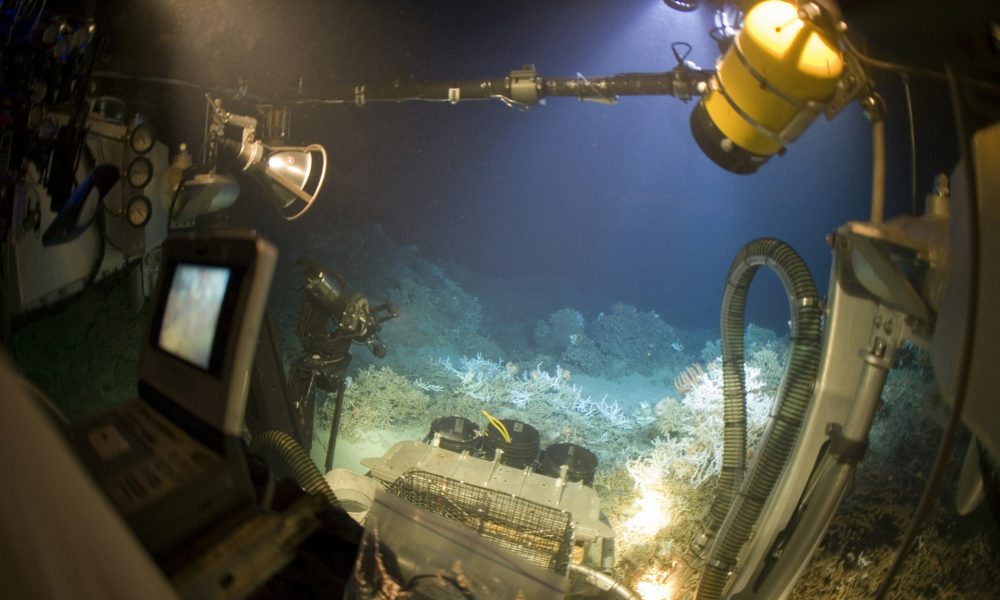

NOAA / Unsplash / The deep-sea remains mostly unknown. Scientists estimate that less than 0.001% of the ocean floor has been explored, and nearly 90% of its species have not been identified.

These ecosystems evolved over millions of years, far from light, noise, and disturbance. Mining would change that in an instant.

Polymetallic nodules sit on the seabed like scattered stones. They contain nickel, cobalt, and copper, but they also grow just millimeters over millions of years. Test mining already shows damage. A Pacific trial backed by The Metals Company cut biodiversity by over 33%. Sediment clouds spread far beyond mining sites, choking life and releasing toxins that may never fully settle again.

Deep-sea mining sits in a legal gray zone. The International Seabed Authority controls mining in international waters, yet it has not finalized commercial rules. It has issued 31 exploration contracts, but no binding safeguards are in place for large-scale extraction.

Roughly 40 countries now support a moratorium or precautionary pause. The United States pushes ahead, citing national security and supply chains. Norway has opened its waters to exploration but has delayed commercial licensing until 2029.

More in Wealth

-

`

Can Lifestyle Changes Improve Your Cognitive Health?

For years, scientists have tied healthy living to stronger brain performance. Now, the 2025 POINTER trial adds new evidence, showing that...

August 23, 2025 -

`

Jason Momoa Shocks Fans With Clean-Shaven Look for ‘Dune 3’

Jason Momoa has officially said goodbye to his signature beard—and it’s for a role that fans have been eagerly anticipating. The...

August 15, 2025 -

`

Why Fast Growth Can Hurt Your Business More Than Help It

Scaling a business is exciting. Growth means progress, more customers, and broader influence. But pushing too hard, too fast can pull...

August 10, 2025 -

`

2 Game-Changing Stocks That Could Build Generational Wealth

There’s no shortage of investment ideas in the market. But every once in a while, a few names emerge that offer...

August 3, 2025 -

`

This Influencer’s Active Videos Inspire, But Offline She Battles a Painful Condition

Aurora McCausland appears full of energy across her TikTok and Instagram feeds. With over 300,000 followers, she’s seen dancing through her...

July 27, 2025 -

`

Top 5 Long-Term ETFs You Should Buy & Hold in 2025

If you are looking for a stress-free way to grow your wealth, long-term ETFs might just be your ticket. These investment...

January 8, 2025 -

`

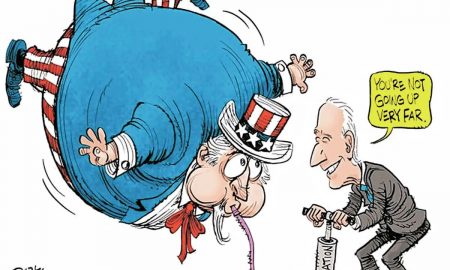

Memes Mock Inflation & Economy As President-Elect Donald Returns to Office

When it comes to tackling serious topics like the economy, political cartoonists have a unique way of making us laugh, think,...

January 8, 2025 -

`

DOJ Offers Google “Extreme” Proposal to Sell Chrome to End ‘Monopoly’

Google’s monopoly is under siege as the U.S. Department of Justice (DOJ) delivers a game-changing proposal. In a bold move, the DOJ...

December 1, 2024 -

`

Behind the Scenes of the 1969 Musical “Sesame Street”

1969 marked a revolutionary moment in television history. It was the birth of “Sesame Street,” a show that would change children’s...

September 10, 2024

You must be logged in to post a comment Login