When Your Side Hustle Becomes a Business & You Haven’t Admitted It Yet?

Most side hustles do not explode overnight. They grow quietly and stack small wins until one day you are running payroll in your head while still calling it “a little project.” The shift rarely comes with fireworks. It sneaks in through steady sales, repeat customers, and late nights spent answering emails instead of watching TV.

At first, the money feels like bonus cash. It pays for dinners out or a weekend trip. Then something changes. The income starts covering rent, car payments, or your phone bill. It starts to feel like a paycheck.

According to InCorp, that mental shift is often the first real signal. When revenue stops feeling optional and starts feeling necessary, you have crossed into business territory.

When the Money Gets Serious!

Olly / Pexels / When customers expect fast replies and consistent quality, your mindset shifts. You stop treating orders as favors and start treating them as commitments.

At the same time, profits stop flowing into your personal spending. You start buying better tools, paying for ads, and upgrading your software. You reinvest because growth matters more than quick rewards.

Yuliya Pearson from InCorp Services points out that by the time people realize they are operating a business, legal and tax obligations are already in motion. The law does not wait for you to change your Instagram bio.

Smart Founders Move Early On

Some entrepreneurs see the shift early and prepare before chaos hits. They build structure before it feels urgent.

Ben Bosworth, founder of Honest Hands Ring Co., kept his engineering job long after his ring company started making real money. He invested in expensive customer management software even when vendors told him his sales volume was too low.

He knew that waiting for a crisis would force him to rebuild under pressure. By setting up systems early, he avoided panic later. That patience protected his growth.

Jocelyn Elizabeth built a $5.2 million resale business while earning $14 an hour at her day job. She ran her operation for five years before quitting. During that time, she built a YouTube channel, hired staff, and tightened her processes.

The Hidden Risks of Staying “Informal”

Calling your hustle a hobby does not shield you from liability. If you operate without formal registration, you and your business are legally the same person. That means your savings account, your car, and even your home can be exposed if someone sues you. A freelance designer who accepts payments through a personal account has no barrier between personal assets and business debts.

Money mixing is another silent problem. When personal and business funds share one account, bookkeeping becomes messy fast. You forget what a client payment was and what your grocery run was.

This confusion leads to missed deductions and messy tax filings. Cleaning up years of tangled records can cost thousands in accounting fees. Lack of structure also blocks growth. Banks and wholesale vendors want a clean financial history. Without it, loans and supply contracts stay out of reach.

The IRS Already Knows!

Tima / Pexels / Even if you do not receive a Form 1099 K, income is taxable once net earnings pass $400. Social media payouts, affiliate commissions, and sponsorship deals leave digital trails.

Waiting to “make it official” does not delay your tax duty. It only delays your preparation.

Smart founders start acting like a company before the paperwork demands it. They open separate bank accounts and track every expense from day one. Plus, they set aside money for taxes instead of hoping the numbers will work out. This habit creates clarity. It also reveals if the business is truly profitable.

The IRS allows up to $5,000 in startup expense deductions in the first year. That incentive alone makes early formalization worth considering.

More in Business

-

`

Jason Momoa Shocks Fans With Clean-Shaven Look for ‘Dune 3’

Jason Momoa has officially said goodbye to his signature beard—and it’s for a role that fans have been eagerly anticipating. The...

August 15, 2025 -

`

Why Fast Growth Can Hurt Your Business More Than Help It

Scaling a business is exciting. Growth means progress, more customers, and broader influence. But pushing too hard, too fast can pull...

August 10, 2025 -

`

2 Game-Changing Stocks That Could Build Generational Wealth

There’s no shortage of investment ideas in the market. But every once in a while, a few names emerge that offer...

August 3, 2025 -

`

This Influencer’s Active Videos Inspire, But Offline She Battles a Painful Condition

Aurora McCausland appears full of energy across her TikTok and Instagram feeds. With over 300,000 followers, she’s seen dancing through her...

July 27, 2025 -

`

Top 5 Long-Term ETFs You Should Buy & Hold in 2025

If you are looking for a stress-free way to grow your wealth, long-term ETFs might just be your ticket. These investment...

January 8, 2025 -

`

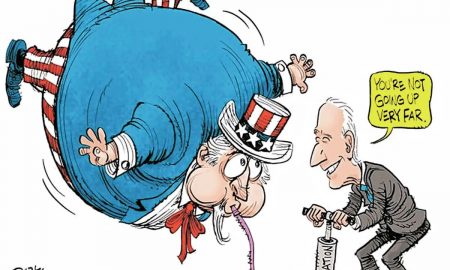

Memes Mock Inflation & Economy As President-Elect Donald Returns to Office

When it comes to tackling serious topics like the economy, political cartoonists have a unique way of making us laugh, think,...

January 8, 2025 -

`

DOJ Offers Google “Extreme” Proposal to Sell Chrome to End ‘Monopoly’

Google’s monopoly is under siege as the U.S. Department of Justice (DOJ) delivers a game-changing proposal. In a bold move, the DOJ...

December 1, 2024 -

`

Behind the Scenes of the 1969 Musical “Sesame Street”

1969 marked a revolutionary moment in television history. It was the birth of “Sesame Street,” a show that would change children’s...

September 10, 2024 -

`

When to Wax Before Vacation for the Best Results?

Planning a vacation involves a lot of preparation, and if waxing is part of that preparation, timing it right is crucial....

September 7, 2024

You must be logged in to post a comment Login