What Lifestyle Creep Is Really Costing You — And How to Stop It

Lifestyle creep — it starts small, almost invisible, but over time it can reshape your entire financial future. As income rises, spending often follows. A nicer car, better restaurants, luxury vacations — they feel well-deserved. But those upgrades, if unchecked, can quietly sabotage long-term security.

The key is not to avoid comfort but to balance it. When expenses grow faster than savings, lifestyle creep begins to take control. Understanding what it costs — and how to manage it — is essential for protecting both present enjoyment and future freedom.

Understanding Lifestyle Creep

Lifestyle creep, or lifestyle inflation, happens when higher income leads to higher spending. It’s a gradual shift that feels harmless — a few more conveniences here, a few premium choices there. But those choices can accumulate into lasting financial pressure.

While it’s natural to enhance quality of life with a pay raise or promotion, the risk lies in how easily temporary upgrades become permanent habits. Once spending adjusts upward, cutting back can feel like deprivation.

Common triggers of lifestyle inflation include:

1. Subtle spending on luxuries that soon become the norm

2. Increasing fixed costs such as rent, cars, or memberships

3. Social pressure — keeping up with others’ lifestyles

4. Underestimating the long-term effects of small financial changes

For high earners, the danger is even greater. Large paychecks can mask poor saving habits, giving the illusion of financial security while savings growth stalls.

When Upgrades Cross the Line

Freepik | Lifestyle creep is the financial threat of spending routinely increasing faster than the growth of savings or income.

Raising one’s standard of living isn’t a problem in itself — enjoying the rewards of hard work is important. However, lifestyle creep becomes a real concern when spending starts growing faster than financial goals.

It often shows up in subtle ways, like impulsive upgrades, convenience purchases, or fixed monthly costs that increase faster than income. Over time, experiences that once felt special can lose their novelty, yet the spending continues simply out of routine.

When the balance between saving and spending tilts too far in the wrong direction, the issue isn’t indulgence — it’s imbalance. The aim should always be to enjoy the present without jeopardizing future stability.

What Lifestyle Creep Really Costs

To see the long-term impact, consider a real-world scenario shared by Kristin McKenna, Senior Contributor and President of Darrow Wealth Management in Boston, MA.

Assumptions:

Starting portfolio: $3,000,000

20 years until retirement, 30 years in retirement

Current annual living expenses: $200,000

Annual savings potential: $70,000

Inflation: 2.5% per year

7% annual return, 12% volatility

Taxes excluded

Scenario 1: Bigger Spending, Lower Security

If an individual increases annual lifestyle spending by $50,000 (a 25% jump), savings drop to $20,000 per year. Retirement expenses rise to $250,000 annually in today’s dollars. What is the probability of maintaining that lifestyle in retirement? Only 75% — below the healthy target of 80%.

Scenario 2: Moderate Spending, Stronger Safety Net

Now, if lifestyle upgrades total $25,000 more per year (around 12.5% higher spending), annual savings rise to $45,000. Retirement needs are slightly lower, at $225,000. Here, the probability of success improves to 85%, offering flexibility to retire earlier or maintain a higher standard of living later.

These figures highlight one truth: spending choices today directly shape financial freedom tomorrow.

Balancing Comforts With Tomorrow’s Goals

Freepik | prevent lifestyle creep by ensuring spending doesn’t grow faster than financial goals.

Money choices are always a trade-off — every dollar spent today is one less for tomorrow’s opportunities. But that doesn’t mean enjoyment must wait. The goal is intentional balance.

Before saying yes to a luxury upgrade or subscription renewal, it helps to pause and ask:

Does this purchase genuinely add value?

Can savings still grow alongside spending?

How does this decision align with long-term financial goals?

When saving grows faster than spending, financial freedom expands — not just in retirement, but throughout life.

Why Awareness Is the Real Advantage

Lifestyle creep isn’t always about indulgence — it’s about habits that quietly expand over time. When higher spending starts to feel normal, cutting back becomes harder than it should. The best defense is mindfulness: tracking where your money goes, setting concrete savings goals, and checking in on your financial plan often. That awareness helps make sure pay raises turn into lasting progress, not fleeting upgrades.

True financial success isn’t measured by income alone but by how much is saved, invested, and allowed to grow. When lifestyle upgrades happen intentionally — with savings rising faster than spending — comfort and long-term security can coexist. Smart, sustainable habits make it possible to live well now without jeopardizing the future.

More in Lifestyle

-

`

Why Fast Growth Can Hurt Your Business More Than Help It

Scaling a business is exciting. Growth means progress, more customers, and broader influence. But pushing too hard, too fast can pull...

August 10, 2025 -

`

2 Game-Changing Stocks That Could Build Generational Wealth

There’s no shortage of investment ideas in the market. But every once in a while, a few names emerge that offer...

August 3, 2025 -

`

This Influencer’s Active Videos Inspire, But Offline She Battles a Painful Condition

Aurora McCausland appears full of energy across her TikTok and Instagram feeds. With over 300,000 followers, she’s seen dancing through her...

July 27, 2025 -

`

Top 5 Long-Term ETFs You Should Buy & Hold in 2025

If you are looking for a stress-free way to grow your wealth, long-term ETFs might just be your ticket. These investment...

January 8, 2025 -

`

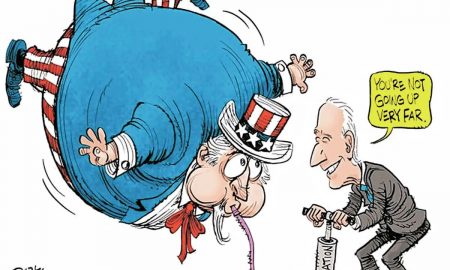

Memes Mock Inflation & Economy As President-Elect Donald Returns to Office

When it comes to tackling serious topics like the economy, political cartoonists have a unique way of making us laugh, think,...

January 8, 2025 -

`

DOJ Offers Google “Extreme” Proposal to Sell Chrome to End ‘Monopoly’

Google’s monopoly is under siege as the U.S. Department of Justice (DOJ) delivers a game-changing proposal. In a bold move, the DOJ...

December 1, 2024 -

`

Behind the Scenes of the 1969 Musical “Sesame Street”

1969 marked a revolutionary moment in television history. It was the birth of “Sesame Street,” a show that would change children’s...

September 10, 2024 -

`

When to Wax Before Vacation for the Best Results?

Planning a vacation involves a lot of preparation, and if waxing is part of that preparation, timing it right is crucial....

September 7, 2024 -

`

How to Work Out the Interest Rate on a Car Loan?

When financing a car, understanding how to work out the interest rate on a car loan is crucial. Whether you’re eyeing...

August 28, 2024

You must be logged in to post a comment Login