Dollar Tree Gains Millions of Wealthy Shoppers While Its Core Low-Income Customers Struggle

Dollar Tree is changing. Once seen as a last stop for tight budgets, it is now pulling in shoppers who earn six figures. Inflation has pushed even comfortable households to look for cheaper options, and Dollar Tree is catching that wave.

But this growth comes with tension. The chain’s original customers, many earning under $60,000 a year, are hurting more than ever. They shop less often, spend more out of need, and cut back on anything that is not essential. Dollar Tree now sits in the middle of two very different financial realities.

Steve / Pixabay / Over the last three months, Dollar Tree added about 3 million new households compared to the same period last year. Around 60% of those new shoppers came from homes earning over $100,000 a year.

That is a big shift for a brand built on low prices and basic goods.

These shoppers are not desperate. They are careful. Grocery bills are up, gas is expensive, and everyday items cost more than they did a year ago. So higher-income families are making smart cuts. They still earn good money, but they want value. Dollar Tree fits that goal.

Company leaders say these shoppers are trading down by choice. They are mixing discount stores with premium ones. They buy snacks, paper goods, and party supplies at Dollar Tree, then head elsewhere for specialty items. It is not about survival. It is about control.

However, this trend is not unique. Walmart recently said about 75% of its market share gains came from households earning over $100,000. The message is clear. Even wealthy shoppers are watching every dollar.

Core Low-Income Shoppers Feel the Squeeze

While new shoppers roll in, Dollar Tree’s foundation is under stress. Traffic fell 0.3% year over year in the most recent quarter. That drop comes mostly from lower-income shoppers visiting less often.

These customers still rely on Dollar Tree. In fact, their average spending is rising faster than that of higher-income newcomers. Recent data shows spending growth for households earning under $60,000 was more than twice as fast as for wealthier shoppers. That sounds positive until you look closer.

Inflation hits these households first and hardest. Rent, food, and utilities take up most of their income. There is little room to adjust.

This pressure shows clearly at Family Dollar, Dollar Tree’s sister brand. Family Dollar serves a lower-income crowd, and sales of non-essential items have dropped sharply. Home decor, seasonal goods, and small treats are being skipped. Shoppers stick to food, cleaning supplies, and basics only.

Internal Problems Add More Risk

Vika / Pixabay / Dollar Tree also faces serious internal challenges. Store conditions have drawn heavy criticism from regulators and analysts alike.

Both Dollar Tree and Dollar General have paid millions in fines for safety violations. Inspectors found cluttered aisles, blocked exits, and understaffed stores. In one major case, Dollar Tree pleaded guilty and paid a $42 million penalty after rodents were found in a food warehouse.

Messy stores matter. Shoppers notice. Wealthier customers, especially, have little patience for chaos. If shelves are bare or aisles are blocked, they leave. Lower-income shoppers may return because they need to, but even they have limits.

Leadership changes add another layer of uncertainty. Dollar Tree recently saw its CEO step down. At the same time, the company is weighing a possible sale of Family Dollar after years of weak performance. Plans are already in place to close about 1,000 Family Dollar locations.

The core Dollar Tree brand is also shifting its identity. The old $1-only model is gone. Many items now sell for $3, $5, or $7. That helps margins and attracts wealthier shoppers, but it risks confusing or alienating long-time customers who depend on rock-bottom prices.

More in Business

-

`

Why Fast Growth Can Hurt Your Business More Than Help It

Scaling a business is exciting. Growth means progress, more customers, and broader influence. But pushing too hard, too fast can pull...

August 10, 2025 -

`

2 Game-Changing Stocks That Could Build Generational Wealth

There’s no shortage of investment ideas in the market. But every once in a while, a few names emerge that offer...

August 3, 2025 -

`

This Influencer’s Active Videos Inspire, But Offline She Battles a Painful Condition

Aurora McCausland appears full of energy across her TikTok and Instagram feeds. With over 300,000 followers, she’s seen dancing through her...

July 27, 2025 -

`

Top 5 Long-Term ETFs You Should Buy & Hold in 2025

If you are looking for a stress-free way to grow your wealth, long-term ETFs might just be your ticket. These investment...

January 8, 2025 -

`

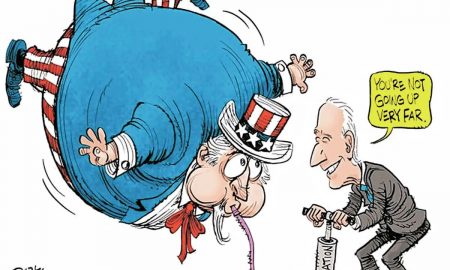

Memes Mock Inflation & Economy As President-Elect Donald Returns to Office

When it comes to tackling serious topics like the economy, political cartoonists have a unique way of making us laugh, think,...

January 8, 2025 -

`

DOJ Offers Google “Extreme” Proposal to Sell Chrome to End ‘Monopoly’

Google’s monopoly is under siege as the U.S. Department of Justice (DOJ) delivers a game-changing proposal. In a bold move, the DOJ...

December 1, 2024 -

`

Behind the Scenes of the 1969 Musical “Sesame Street”

1969 marked a revolutionary moment in television history. It was the birth of “Sesame Street,” a show that would change children’s...

September 10, 2024 -

`

When to Wax Before Vacation for the Best Results?

Planning a vacation involves a lot of preparation, and if waxing is part of that preparation, timing it right is crucial....

September 7, 2024 -

`

How to Work Out the Interest Rate on a Car Loan?

When financing a car, understanding how to work out the interest rate on a car loan is crucial. Whether you’re eyeing...

August 28, 2024

You must be logged in to post a comment Login