Google Co-Founders Flee California As Bernie Sanders-endorsed ‘Billionaire Tax’ Looms

California has always sold itself as the land of big ideas and bigger fortunes. Now it is testing how much wealth it can hold before it slips away. The proposed 2026 Billionaire Tax Act has turned into a flashpoint, and some of the state’s richest residents are already acting.

Google co-founders, Larry Page and Sergey Brin, did not wait for election night. Reports show both Google co-founders are reshaping their financial footprints as the tax inches closer to the ballot. The message is clear. When the rules change, even tech legends rethink where they call home.

The Tax Targets the Ultra-rich

Sanders / IG / The proposed tax says that any California resident with a net worth above $1 billion would face a one-time 5% tax.

However, the catch is timing. If voters approve it in November 2026, it applies retroactively to anyone who lived in the state on January 1, 2026.

That retroactive clause has rattled nerves. Wealth is not just cash in a bank account. It includes stocks, bonds, and business stakes, even if those assets have not been sold. Primary homes are excluded, and art under $5 million gets a pass, but most high-end holdings stay on the table. The state would allow payment over five years, yet the bill could still reach billions for a single person.

Supporters say the goal is urgent and moral. The Service Employees International Union-United Healthcare Workers West is leading the charge. They argue the tax could raise up to $100 billion. About 90% would go to healthcare programs, with the rest funding food assistance and education.

In their view, this is a direct response to federal healthcare cuts and a fair ask from those who have gained the most.

Why Page and Brin Are Quietly Pulling Back

Boli / Unsplash / Google co-founders are reshaping their financial footprints as the tax inches closer to the ballot.

Many were shifted to Delaware, Nevada, Florida, and Texas. These were not shell companies. They included his family office and major investment vehicles.

Sergey Brin followed a similar path. An entity tied to him relocated or dissolved 15 California LLCs, moving them to Nevada just days before Christmas. The timing raised eyebrows. These moves came well before voters get a say, signaling a preemptive strike rather than a symbolic protest.

Real estate tells another part of the story. Page bought two waterfront estates in Miami for a combined $173.4 million. A trust linked to him also picked up a $71.9 million mansion in the same area. While both founders still own California homes, these Florida purchases look less like vacation spots and more like anchors. Florida has no state income tax and no appetite for wealth taxes.

The billionaire tax has exposed deep cracks within California’s Democratic Party. Progressive lawmakers and labor groups frame it as common sense. They point out that U.S. billionaires see average annual wealth growth of about 7.5%. In that light, a one-time 5% tax looks modest. Even after paying, most fortunes would keep growing.

The Billionaire Tax Has Put Stakeholders in Jeopardy

High-profile voices have joined the chorus. Senator Bernie Sanders has praised the idea as a model for the nation. Representative Ro Khanna backs it too, calling it a fair way to fund healthcare for working families. For supporters, this is not about punishment. It is about priorities.

Opponents see it very differently. Many tech leaders warn that the tax will drive money, jobs, and innovation out of California. Venture capital figures like David Sacks and Reid Hoffman have used blunt language, calling the proposal extreme and destructive. Their biggest fear centers on taxing unrealized gains. Founders could owe massive sums based on the stock value they have not cashed out.

More in Business

-

`

Redefining Wealth Management for a Multi-Generational Future

Wealth today is no longer just about financial capital. It represents values, priorities, and the vision families carry into the future....

August 30, 2025 -

`

Can Lifestyle Changes Improve Your Cognitive Health?

For years, scientists have tied healthy living to stronger brain performance. Now, the 2025 POINTER trial adds new evidence, showing that...

August 23, 2025 -

`

Jason Momoa Shocks Fans With Clean-Shaven Look for ‘Dune 3’

Jason Momoa has officially said goodbye to his signature beard—and it’s for a role that fans have been eagerly anticipating. The...

August 15, 2025 -

`

Why Fast Growth Can Hurt Your Business More Than Help It

Scaling a business is exciting. Growth means progress, more customers, and broader influence. But pushing too hard, too fast can pull...

August 10, 2025 -

`

2 Game-Changing Stocks That Could Build Generational Wealth

There’s no shortage of investment ideas in the market. But every once in a while, a few names emerge that offer...

August 3, 2025 -

`

This Influencer’s Active Videos Inspire, But Offline She Battles a Painful Condition

Aurora McCausland appears full of energy across her TikTok and Instagram feeds. With over 300,000 followers, she’s seen dancing through her...

July 27, 2025 -

`

Top 5 Long-Term ETFs You Should Buy & Hold in 2025

If you are looking for a stress-free way to grow your wealth, long-term ETFs might just be your ticket. These investment...

January 8, 2025 -

`

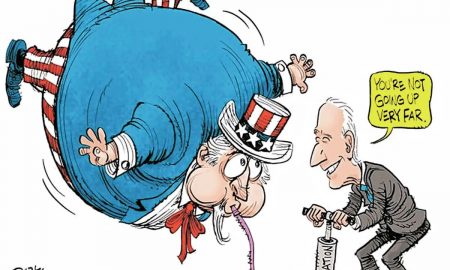

Memes Mock Inflation & Economy As President-Elect Donald Returns to Office

When it comes to tackling serious topics like the economy, political cartoonists have a unique way of making us laugh, think,...

January 8, 2025 -

`

DOJ Offers Google “Extreme” Proposal to Sell Chrome to End ‘Monopoly’

Google’s monopoly is under siege as the U.S. Department of Justice (DOJ) delivers a game-changing proposal. In a bold move, the DOJ...

December 1, 2024

You must be logged in to post a comment Login