Finally Some Good News Ease Student Loan Debts During the COVID-19 Crisis

Having one’s source of income suddenly become unstable is among the most stressful things a person can experience. It can lead to a domino effect further affecting other aspects of their life and finances. The ongoing coronavirus pandemic experienced by people all over the world is the catalyst that has led some to lose resources to pay off their debts like student loans.

The good news is that the American government has promised to implement measures to aid those who are unable to pay off their monthly dues. What more, there are plenty of ways people can significantly decrease their loan payments.

Paused Payments

Unsplash | Over 92% of student loans are federal loans

President Donald Trump has reportedly announced that Americans who have federal student loans will be granted the chance to pause with their payments. This also means that they won’t be accruing added interest for the coming three months, which can then be potentially extended to cover half a year.

Opting for an Extended Plan

Another thing struggling borrowers could do at this time is to switch to the Extended Repayment Plan. The option entails, as its name implies, an expanded payment timeline (25 years) that would lead to paying less monthly. One downside of choosing this route is that one would have to pay more in interest in the long run.

A Graduated Payment Plan

Unsplash | The eventual ramping up of payment amounts allows graduates to pay more as their income grows

The Graduated Repayment Plan may be a better option for those who don’t want to pay more interest though. Like the automatic Standard Repayment Plan, it encompasses a decade of payments but differs in the stipulation that borrowers will begin with smaller payments with it increasing as years go on.

Income-tied Options

One last payment option people should look into are the Income-Driven Repayment (IDR) plans. These are particularly relevant given the current reduced hours or unemployment issues some may be facing due to the coronavirus pandemic.

All plans in this category consider the borrower’s family size and income when calculating for their monthly dues. Usually, people would have to pay up to 20% of their salary for their student loans. After 25 years of paying on time, one can even qualify for forgiveness on the remaining amount they still owe.

Refinancing & Consolidation

Unsplash | Borrowers can apply for student loan consolidation online

Those who took out private loans can decrease their monthly payments by refinancing. This means applying for a new loan, which has a lower interest, from another lender to replace one’s previous high-interest loan. Meanwhile, borrowers with multiple loans will benefit from consolidating their debts into one so that they can cut down on interest costs.

More in Business

-

`

Brian Cornell Exits as Target CEO, Michael Fiddelke to Lead Next Chapter

Target is preparing for a major leadership change. Brian Cornell, who has led the company for nearly a decade, will step...

September 6, 2025 -

`

Redefining Wealth Management for a Multi-Generational Future

Wealth today is no longer just about financial capital. It represents values, priorities, and the vision families carry into the future....

August 30, 2025 -

`

Can Lifestyle Changes Improve Your Cognitive Health?

For years, scientists have tied healthy living to stronger brain performance. Now, the 2025 POINTER trial adds new evidence, showing that...

August 23, 2025 -

`

Jason Momoa Shocks Fans With Clean-Shaven Look for ‘Dune 3’

Jason Momoa has officially said goodbye to his signature beard—and it’s for a role that fans have been eagerly anticipating. The...

August 15, 2025 -

`

Why Fast Growth Can Hurt Your Business More Than Help It

Scaling a business is exciting. Growth means progress, more customers, and broader influence. But pushing too hard, too fast can pull...

August 10, 2025 -

`

2 Game-Changing Stocks That Could Build Generational Wealth

There’s no shortage of investment ideas in the market. But every once in a while, a few names emerge that offer...

August 3, 2025 -

`

This Influencer’s Active Videos Inspire, But Offline She Battles a Painful Condition

Aurora McCausland appears full of energy across her TikTok and Instagram feeds. With over 300,000 followers, she’s seen dancing through her...

July 27, 2025 -

`

Top 5 Long-Term ETFs You Should Buy & Hold in 2025

If you are looking for a stress-free way to grow your wealth, long-term ETFs might just be your ticket. These investment...

January 8, 2025 -

`

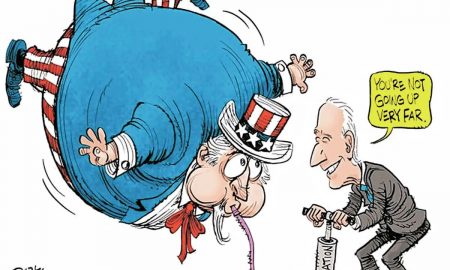

Memes Mock Inflation & Economy As President-Elect Donald Returns to Office

When it comes to tackling serious topics like the economy, political cartoonists have a unique way of making us laugh, think,...

January 8, 2025

You must be logged in to post a comment Login