Shattering 3 of The Most Common Money Myths

As one embarks on his financial journey, he comes across random bits of financial advice, out of which many are total myths. And guess what, those myths are widely held and have been followed over the years. So much so that the youngsters don’t even question their rationality! But, how long can we hold on to such misconceptions and lack proper financial knowledge? How long do we let ourselves sink in the dark pit of oblivion?

Alexander Mils/Unsplash | The money market is full of delusional advice that may sound good but doesn’t yield benefits in the long run

Although many such delusions have been busted in the finance realm over the years, the money market still needs good filtering. Keeping that in mind, here are three money myths and real facts that prove them wrong. Stay on to know more!

Myth 1: More the salary, more the happiness

One of the most common misconceptions is that once you attain the goal of a six or seven-digit salary, you will lead a happily ever after. Well, myth alert!

Considering the increase in the market prices of food, petrol, medicines, etc., the cost of survival is ever-increasing. So, alongside the increase in extravagance, a salary increase also implies an increase in the unavoidable costs.

Not to sound philosophical, but it’s really silly to measure the parameter of happiness with an increase in salary. According to a study, people earning high salaries weren’t any happier than the ones with low-income. In fact, the study showed that earning beyond the essential amount decreased the levels of happiness. Hence, stop obsessing over the digits and do what really makes your soul happy.

Cottonbro/Pexels | One of the most common misconceptions is that once you attain the goal of a six or seven-digit salary, you will lead a happily ever after. But true happiness lies in not obsessing over the numbers

Myth 2: Retirement is a long way, save for it later

For someone who’s in his mid-20s, this notion is ubiquitous. The first 5-6 years of working life are spent splurging to a great level and then when people are past 35, the thought of saving hits them. Plus, some of them even have this notion that saving is effective only when they receive a high salary. However, after busting the first myth, we hope you’ve changed your conviction now.

It has been proven time and again that the sooner you start saving, the deep-pocketed you’ll be. Plus, retirement is believed to be one’s golden years and we hope you too want your retirement to look the same way. So, ditch these false notions and begin your saving journey rightaway.

Myth 3: Budgets are ineffectual

Now, this is something that’s highly misinterpreted!

A budget is a solid plan based on your financial status which is created with the sole notion of saving and controlling your mindless splurging. It’s true; adjusting to the determined budget and obtaining the fruits takes time and requires a lot of effort, and TBH, this is where most people fall back, but once you’re all set, you’d be literally shocked to experience the wonders of the strategy.

You’d know how much money is incoming and how much is outgoing, and that would enable you to not cut back on your entertainment expenses. Plus, it would ensure that you stay debt-free for the longest of times. Isn’t that great?

Olia Danilevich/Pexels | A budget is a plan based on your financial status which is created with the sole notion of saving and controlling your mindless splurging

To wrap it up

Managing the finances is already taxing; one wrong step can prove to be pricey. So, why aggravate that by paying heed to these misconceptions? Debunk these delusions right away and sail smoothly!

More in Wealth

-

`

Jason Momoa Shocks Fans With Clean-Shaven Look for ‘Dune 3’

Jason Momoa has officially said goodbye to his signature beard—and it’s for a role that fans have been eagerly anticipating. The...

August 15, 2025 -

`

Why Fast Growth Can Hurt Your Business More Than Help It

Scaling a business is exciting. Growth means progress, more customers, and broader influence. But pushing too hard, too fast can pull...

August 10, 2025 -

`

2 Game-Changing Stocks That Could Build Generational Wealth

There’s no shortage of investment ideas in the market. But every once in a while, a few names emerge that offer...

August 3, 2025 -

`

This Influencer’s Active Videos Inspire, But Offline She Battles a Painful Condition

Aurora McCausland appears full of energy across her TikTok and Instagram feeds. With over 300,000 followers, she’s seen dancing through her...

July 27, 2025 -

`

Top 5 Long-Term ETFs You Should Buy & Hold in 2025

If you are looking for a stress-free way to grow your wealth, long-term ETFs might just be your ticket. These investment...

January 8, 2025 -

`

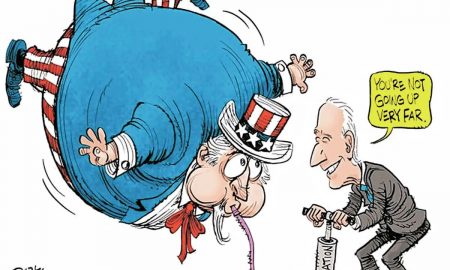

Memes Mock Inflation & Economy As President-Elect Donald Returns to Office

When it comes to tackling serious topics like the economy, political cartoonists have a unique way of making us laugh, think,...

January 8, 2025 -

`

DOJ Offers Google “Extreme” Proposal to Sell Chrome to End ‘Monopoly’

Google’s monopoly is under siege as the U.S. Department of Justice (DOJ) delivers a game-changing proposal. In a bold move, the DOJ...

December 1, 2024 -

`

Behind the Scenes of the 1969 Musical “Sesame Street”

1969 marked a revolutionary moment in television history. It was the birth of “Sesame Street,” a show that would change children’s...

September 10, 2024 -

`

When to Wax Before Vacation for the Best Results?

Planning a vacation involves a lot of preparation, and if waxing is part of that preparation, timing it right is crucial....

September 7, 2024

You must be logged in to post a comment Login