Key Indicators to Monitor as an Investor in 2024

Welcome to 2024! As an investor, you are navigating a financial seascape that is constantly reshaped by new trends and timeless economic principles. This year, more than ever, understanding what to focus on can make a significant difference in your investment journey.

Let’s dive into some key areas you should keep your eyes on, presented in a fresh, engaging, and authoritative tone.

Changing Consumer Behaviors and Market Dynamics

Post-pandemic life has brought about significant shifts in consumer habits. Online shopping, health and wellness, and sustainable products are more than trends. They are becoming staples. For investors, understanding these shifts is critical.

Canva / Pexels / As always. Consumer behavior is set to change in 2024! Watch out for it to excel in your investment journey.

Ask yourself: Which companies are innovating in response to these changes? How are traditional industries adapting? Keeping a pulse on these shifts can reveal hidden gems in the market.

The Rise of Environmental, Social, and Governance (ESG) Investing

2024 marks a year where ESG factors become more than just buzzwords. Investors are increasingly recognizing that companies prioritizing sustainability, social responsibility, and ethical governance are not only doing good but also potentially doing well financially.

This year, watch for companies leading in ESG practices, as they could offer sustainable long-term growth prospects. Monitoring ESG metrics and understanding their impact on various industries will be crucial for forward-thinking investors.

Cryptocurrency and Blockchain Evolution

Cryptocurrency and blockchain continue to be at the forefront of technological disruption. In 2024, we are very likely to see further maturation of this space, including regulatory developments and increased institutional adoption.

RDNE / Pexels / More than ever before, the crypto and blockchain industries will shine. Keep a keen eye on them.

However, the inherent volatility and the evolving regulatory landscape present both opportunities and risks. Investors should approach this area with a balanced view, focusing on long-term potential and avoiding the hype.

Global Geopolitical Developments

Our interconnected world means that geopolitical events have immediate and profound impacts on markets. In 2024, investors need to keep an eye on international politics, trade negotiations, and regional conflicts.

These factors can affect global markets, from commodity prices to foreign exchange rates. A savvy investor will monitor these developments, understanding their potential ripple effects.

Technological Innovations Across Sectors

Technology continues to be a critical driver of market change. In 2024, look beyond the usual tech giants. Focus on emerging technologies in areas like artificial intelligence, quantum computing, and biotech. These sectors hold the potential for significant growth but also come with risks.

RDNE / Pexels / As AI took the corporate world by storm in the outgoing 2023, it is all set to evolve in 2024. Keep an eye on it and thrive.

The key is to identify companies that are not just tech-focused but are leveraging technology to solve real-world problems.

Economic Indicators in the Post-Pandemic World

Finally, in 2024, we can not ignore the broader economic backdrop. The world is still adjusting to the post-COVID era. Key economic indicators such as inflation rates, employment figures, and GDP growth will provide insights into the health of the global economy.

So, investors should use these indicators to gauge market sentiment and identify sectors that may thrive or falter in the current economic climate.

There you have it! A roadmap for investing in 2024 that is as dynamic as the markets themselves. By focusing on these six areas, you can better position yourself to make informed, strategic investment decisions.

Keep in mind that successful investing is about understanding the larger picture and adapting to an ever-changing financial landscape.

More in Wealth

-

`

Jason Momoa Shocks Fans With Clean-Shaven Look for ‘Dune 3’

Jason Momoa has officially said goodbye to his signature beard—and it’s for a role that fans have been eagerly anticipating. The...

August 15, 2025 -

`

Why Fast Growth Can Hurt Your Business More Than Help It

Scaling a business is exciting. Growth means progress, more customers, and broader influence. But pushing too hard, too fast can pull...

August 10, 2025 -

`

2 Game-Changing Stocks That Could Build Generational Wealth

There’s no shortage of investment ideas in the market. But every once in a while, a few names emerge that offer...

August 3, 2025 -

`

This Influencer’s Active Videos Inspire, But Offline She Battles a Painful Condition

Aurora McCausland appears full of energy across her TikTok and Instagram feeds. With over 300,000 followers, she’s seen dancing through her...

July 27, 2025 -

`

Top 5 Long-Term ETFs You Should Buy & Hold in 2025

If you are looking for a stress-free way to grow your wealth, long-term ETFs might just be your ticket. These investment...

January 8, 2025 -

`

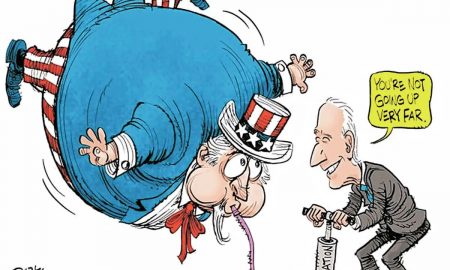

Memes Mock Inflation & Economy As President-Elect Donald Returns to Office

When it comes to tackling serious topics like the economy, political cartoonists have a unique way of making us laugh, think,...

January 8, 2025 -

`

DOJ Offers Google “Extreme” Proposal to Sell Chrome to End ‘Monopoly’

Google’s monopoly is under siege as the U.S. Department of Justice (DOJ) delivers a game-changing proposal. In a bold move, the DOJ...

December 1, 2024 -

`

Behind the Scenes of the 1969 Musical “Sesame Street”

1969 marked a revolutionary moment in television history. It was the birth of “Sesame Street,” a show that would change children’s...

September 10, 2024 -

`

When to Wax Before Vacation for the Best Results?

Planning a vacation involves a lot of preparation, and if waxing is part of that preparation, timing it right is crucial....

September 7, 2024

You must be logged in to post a comment Login